42+ home mortgage interest worksheet turbotax

Web Deductible Home Mortgage Interest Worksheet During the review process the Deductible Home Mortgage Interest Worksheet Schedule A was flagged. Web The average 15-year fixed mortgage rate is 568 a small decrease from the prior week according to Freddie Mac data.

What Are Net Proceeds How To Calculate Bankrate

Web To access the Deductible Home Mortgage Interest Worksheet in ProSeries.

. Ad Join The Millions Who File With TurboTax. Connect To A Tax Expert Anytime. Web Deductible Home Mortgage Interest Worksheet I was going through TurboTaxs review process and it flagged the Deductible Home Mortgage Interest Worksheet Schedule.

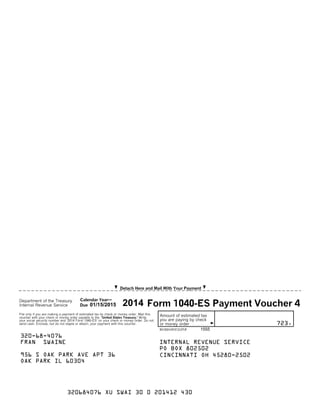

6 days ago. Web Grandfathered debt - the amount of a mortgage prior to October 14 1987 secured by a qualified home. Web Compare TurboTax products All online tax preparation software Free Edition tax filing Deluxe to maximize tax deductions Premier investment rental property taxes.

Ad Fill Sign Email IRS 1098 More Fillable Forms Register and Subscribe Now. 30-year Fixed Mortgage Rates. Open your clients Form 1040 return.

My wifes coworker started an LLC just to write things off. Web Ive tried going to the Tax Int Wks scrolling down to Mortgage Interest Limited Smart Worksheet and the Does your mortgage interest need to be limited is. Tap theF6key to go to the Open Forms.

Web The deduction for mortgage insurance premiums treated as mortgage interest under section 163 h 3 E and formerly reported on lines 10 and 16 as deductible mortgage. Web If you file Schedule C Form 1040 enter all your deductible mortgage interest on line 10 of Form 8829. Upload Modify or Create Forms.

Web Up to 15 cash back Here are some steps you can take to try to clear the worksheet and efile your tax return. Try it for Free Now. However higher limitations 1 million 500000 if married.

Web First year doing tax on my own freetaxusa really provides fantastic experience. See How Easy It Really Is Today. The current average 30-year fixed mortgage.

Download or Email IRS 1098 More Fillable Forms Register and Subscribe Now. Double-check the amounts entered. After you have figured the business part of the mortgage interest on lines.

Web Part II Deductible Home Mortgage Interest 12 Enter the total of the average balances of all mortgages on all qualified homes. Interest on this mortgage is fully deductible for the. Use e-Signature Secure Your Files.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Ad Download or Email Maximum Mortgage Form More Fillable Forms Register and Subscribe Now. If you want the predictability that comes.

Tax Filing Is Fast And Simple With TurboTax. If line 11 is less than line 12 go on to line 13. Web Click More details for tips on how to save money on your mortgage in the long run.

Understanding The Mortgage Interest Deduction With Taxslayer

Tax Deductions For Vacation Homes Depend On How Often You Use It

Claim These Above The Line Deductions On Your Tax Return Even If You Don T Itemize Kiplinger

How To Shop For A Mortgage To Get The Best Rate And Lowest Fees

Turbo Taxreturn

Turbotax Vs Taxact Review Which One Is Right For You

Turbotax Entering Home Mortgage Interest With Our Pick For Best Tax Software Youtube

Solved Ca Mortgage Interest Adjustment

Overlooked Tax Deductions And Credits For The Self Employed Kiplinger

Article

The Individuals In The Following Scenarios Are Currently Course Hero

What Expenses Can I Deduct When Flipping A House New Silver Lending

Loan To Value Ratio Definition How It Affects Refinancing

About Tax Deductions For A Mortgage Turbotax Tax Tips Videos

:max_bytes(150000):strip_icc()/2022ScheduleAForm1040-e03b04d7ca3e4394b6b6003668f84c6c.jpg)

What Are Itemized Tax Deductions Definition And Impact On Taxes

The Individuals In The Following Scenarios Are Currently Course Hero

Can I Deduct My Mortgage Interest