31+ ideal mortgage to income ratio

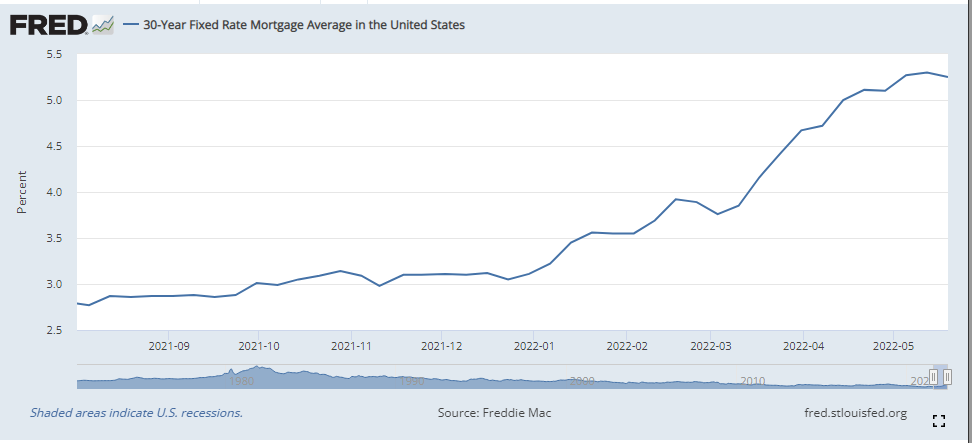

Ad Compare Home Financing Options Online Get Quotes. Web For example a 30-year fixed-rate mortgage has a higher Mortgage to Income Ratio than an 8-year variable-rate mortgage.

Finally A Stock Market Crash Mr Money Mustache

Comparisons Trusted by 55000000.

. Web Ideally lenders prefer a debt-to-income ratio lower than 36 with no more than 28 of that debt going towards servicing a mortgage or rent payment. Debt to income ratio 3485 divided by 10000 03485 3485 or 35 just under the suggested maximum. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web Lenders typically say the ideal front-end ratio should be no more than 28 and the back-end ratio including all expenses should be 36 or lower. 1 2 For example assume. Web The Ideal Ratio The ideal debt-to-income ratio is 36 or lower.

Find A Lender That Offers Great Service. Compare More Than Just Rates. Get Your Quote Today.

Apply See If Youre Eligible for a Home Loan Backed by the US. Ad Are you eligible for low down payment. Web Total monthly household income before tax 10000.

Your front-end DTI includes just your. Web Mortgage lenders often look at your front-end and back-end debt-to-income ratios when they review your loan application. Web Ideally lenders prefer a debt-to-income ratio lower than 36 with no more than 28 of that debt going towards servicing a mortgage or rent payment.

VA Loan Expertise and Personal Service. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Banks want to lend to homebuyers with lower ratios in general as those with higher ratios are.

And 43 or higher will cause red flags that may significantly impact your. Compare Lenders And Find Out Which One Suits You Best. Save Real Money Today.

Get Your Home Loan Quote With Americas 1 Online Lender. Web Typically a DTI of 36 or below is considered good. Looking For a House Loan.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web A good debt-to-income ratio is often between 36 and 43 but lower is usually better when it comes to applying for a mortgage. Contact a Loan Specialist.

Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. Find all FHA loan requirements here. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Web To calculate your DTI ratio add up your recurring monthly debt payments including credit card student loan mortgage auto loan and other loan payments and divide the sum. This is because the 30-year fixed. 37-42 is considered manageable.

Ad 5 Best House Loan Lenders Compared Reviewed. Web The debt-to-income DTI ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments and is used by lenders to.

Why Is It Good To Invest In Real Estate Mortgage Magic That S Why

An Analysis Of The Uk Development Industry S Role In Brownfield Regeneration Emerald Insight

Debt To Income Ratio Calculator How It Affect Mortgages Moneygeek

9 Best Property Management Companies In Bozeman Mt 2023

3 Powerful Lessons From My Real Estate Portfolio After 7 Years

2022 23 Huntsville Isd Benefit Guide By Fbs Issuu

131 W Oldfield St Alpena Mi 49707 Zillow

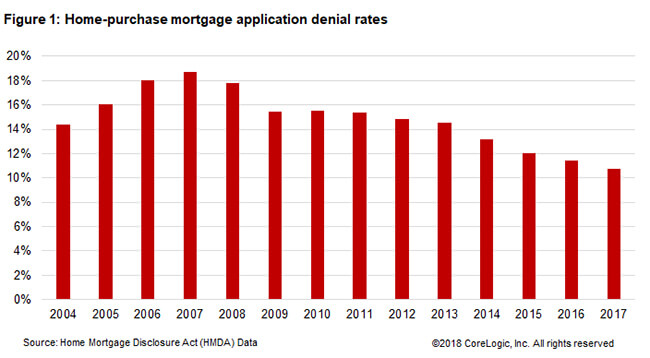

Debt To Income Is The Number One Reason For Denied Mortgage Applications Corelogic

American Capital Agency Runs Its Favorite Play A Secondary After Going Ex Dividend Nasdaq Agnc Seeking Alpha

Mortgage Broker In Birkdale Thornside Wakerley Mortgage Choice

Chapter 9

Percentage Of Income For Mortgage Payments Quicken Loans

How Much Can I Afford Home Loan Affordability Calculator

Mortgage Income Calculator Nerdwallet

Speakers 2023 Nahrep Homeownership Wealth Building Conference

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Mortgage Income Calculator Nerdwallet